备考图书教材专区(上新) 课程咨询

- 备考礼包 【银行】面试礼包 【国家烟草】笔试礼包

- 近期热门 2026版国家公务员图书(教材/珍题/书课包)

- 考生推荐 第4版公务员考试必刷10000题 公考时政周刊

- 限时免费 2025年国面高分计划网课 中储粮考试资料包

爆款精品网课专区(上线) 课程咨询

- 爆款网课 新疆公务员面试网课 事业单位面试网课

- 近期热门 26年980公务员笔试系统提升班 含图书

- 考生推荐 2026年公务员笔试悦享伴学班【含图书】

- 低价秒杀 医师资格证 教师考编 文职专业科目图书

报名:详见公告考试:详见公告

报名:详见公告考试:详见公告

报名:详见公告考试:详见公告

报名:详见公告考试:详见公告

报名:详见公告考试:详见公告

报名特岗教师需要注意什么?

报名特岗教师需要注意什么?

报名特岗教师需要注意什么?

报名特岗教师需要注意什么?

Famous teacher of Huatu

华图师资-新疆

华图教育成立于2001年,秉承“以教育推动社会进步”的使命…

华图教育荣获百度教育盛典"砥志研思奖"…

好老师、好课程、好服务是教育行业的良心…

专升本和普通本科报考公务员考试…

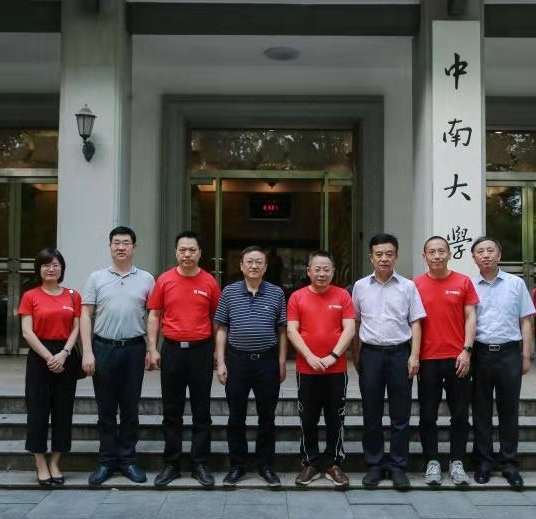

2021年6月21日,中南大学2021届选调生出征仪式暨“华图教育基金”捐赠签约仪式于中南大学隆重举行。中南大学党委常委、副校长朱学红,党委副书记、纪委书记伍海泉,党委副书记黄健陵,华图教育董事长易定宏出席。

今年,是华图的20周岁生日。20年来,华图始终没有忘记作为教育企业所肩负的社会责任,始终热心公益事业,参与了包括抗震救灾、扶贫捐款、大学生就业创业等项目,始终走在公益前线。

今年春天,华图和“新冠”有一场战争。这场战争,对我们而言,是一次危机,更是一次检验。无数华图人,坚守岗位,严阵以待。

在抗击疫情的关键阶段,华图教育党委积极响应党中央号召,号召广大党员不忘入党初心、勇担职责使命,积极主动捐款。截止3月2日,华图教育各部门、各分子公司党员群众共捐款30.5万元,让全体员工的爱心之光照亮战疫之路。在此之前,华图教育推出“多一次

近日,针对全国多地集中爆发新型冠状病毒感染的肺炎疫情,华图教育管理层在思想上高度重视,采取一切必要的措施,确保公司员工、老师和学员的健康安全。同时,公司克服全国防控疫情带来的不便,想方设法满足学员的学习需求。

12月31日,华图教育集团CEO张仕友一行来桑植县开展捐资助学活动,捐款200万元用于支持细砂坪学校建设。副市长欧阳斌、尚生龙,县委副书记、县长赵云海,张家界市人民政府驻北京联络处主任朱爱民,副县长王茂蓉、陈荣昌出席活动。

华图微信公众号

基地华图微信号